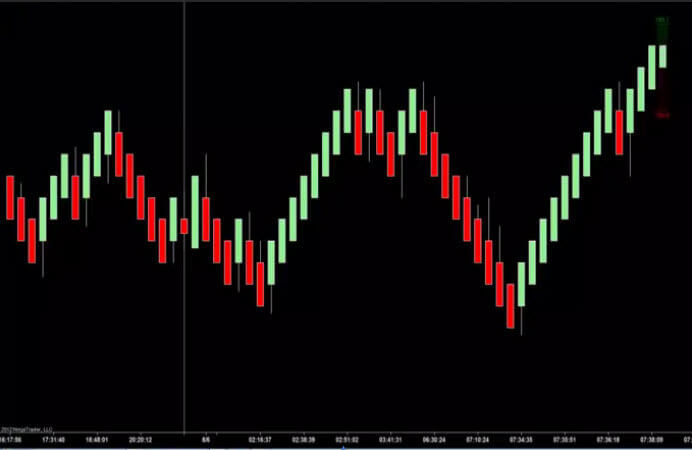

NinjaTrader Indicators

Trade Forecaster

Forecasts Market Activity

This Tool Forecasts Oncoming Trading Conditions BEFORE they Happen

Weather patterns tend to repeat themselves, making it possible to forecast future weather. Just think of how your life would be without ever knowing the weather forecast! Caught in rain storms, too much clothing, not enough, bad times to drive, etc.

Now think of having a trade forecasting tool which predicts oncoming trading patterns. Trade Forecaster will tell you, much in the same way that a weatherman tells you, what to expect, allowing you to properly prepare your strategy in advance. There’s no need to be caught out in the rain – or “chop” as it is in trading.

Better yet, wouldn’t it be nice to receive the forecast of an imminent trend move?

Traders have found this tool to be of enormous assistance by giving them more time to get their trading strategy ducks in a row and identify trade opportunities earlier. It makes for a much more relaxed, and safer trading session when you have a running forecast of what’s coming at you.

Many traders only realize, for example, that they are in the chop when it’s too late. Had they known the chop was coming, they could have been ready with a more appropriate strategy.

Trade Forecaster will alert you to oncoming scalp, swing or trend trading conditions and will work with any system on NinjaTrader.

Key Features

- Forecasts scalp, swing, and trending environments

- Enables you to trade safer by forecasting trading conditions

- Gives you more time to form strategy and recognize patterns

If you do not receive your Download Instructions email after purchasing, please be sure to double check your spam folder, and also add @indicatorwarehouse.com to your safe senders list.