NinjaTrader Indicators

Overbought-Oversold Suite (OBOS)

Detect a Trend Reversal with Accuracy and Ease

If the Market is going to Reverse, the OBOS will catch it!

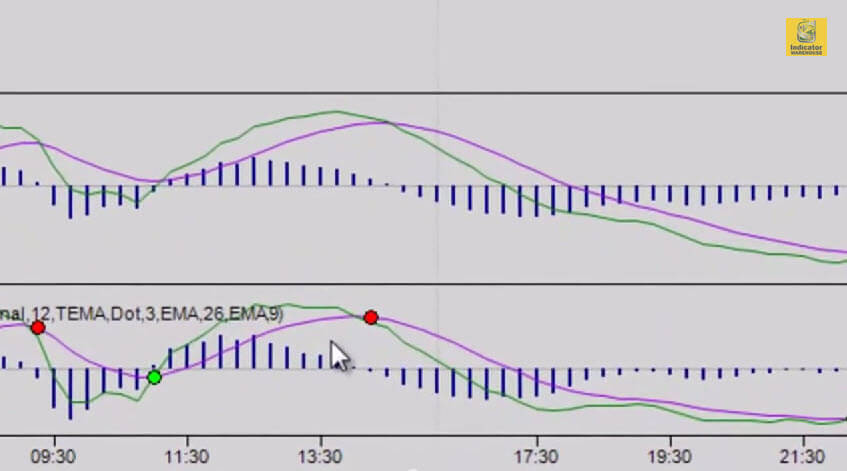

This trading tool aggregates the top Overbought-Oversold trading indicators into one tight day trading power tool that can identify key trading conditions using Stochastics, StochasticsFast, RSI, MFI, CCI, Williams%R, or ADX indicator.

Now integrated into NinjaTrader’s Market Analyzer!

Includes “Arrows” settings that will output a colored Arrow, Triangle, Dot or Square to the price chart depending on the condition of the oscillator.

The “Background” settings will colorize the background of the oscillator sub-panel based on the condition of the oscillator, when it is in OB or OS territory.

The “Parameters Stoch” category controls the oscillator when you’ve selected OscillatorType of “Stochastics” or “StochasticsFast” indicator.

The “Stoch Alert” category contains parameters that are Specialized for the “Stochastics” and “StochasticsFast” oscillators.

All this and more are included with the indicator in the User Guide.

Key Features:

- Generate Sound Alerts when an oscillator crosses crosses above an Overbought (OB) condition or below an Oversold (OS) condition

- Keep your screen uncluttered by drawing visual alerts on the primary price chart representing conditions identified by the indicator.

- Color chart background of the oscillator sub-panel based on the condition of the indicator.

If you do not receive your Download Instructions email after purchasing, please be sure to double check your spam folder, and also add @indicatorwarehouse.com to your safe senders list.