Day Trading Tips and Tricks

Automated Trading Software

Man vs. Machine…

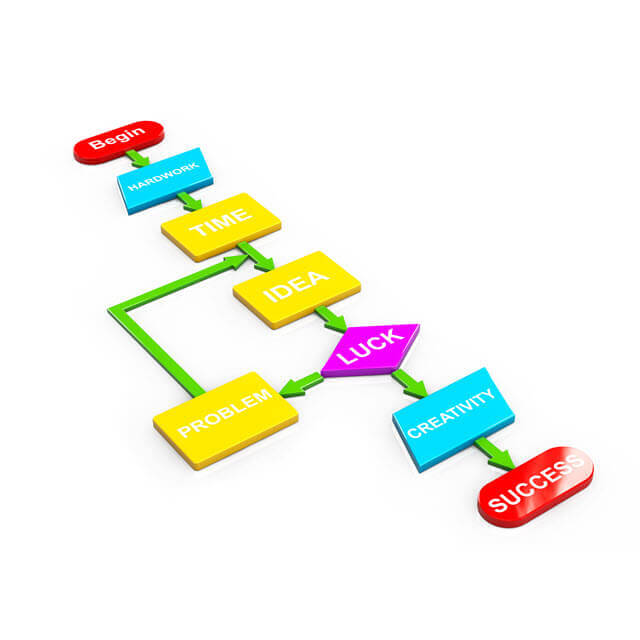

Recently, I was asked if we are creating Automated Trading software for the Diversified Trading System (DTS). The answer is Yes. But it’s still far out. Why? Because while the math of this Automated Trader is based on our Trading Systems; the program is being designed for an automated trading environment.

IMHO, a common misunderstanding is that one can automate how humans trade and that humans can trade the way machines do. Each “device” has its strengths and weaknesses. I believe humans can be better traders than machines because they can process more nuances than a computer. “Subtle” is tough to code. But, humans suffer from inconsistent execution and follow through. This situation is not the case with an automated system. A computer can be depended on to take the same trade under the same conditions every single time.

The challenge with Automated trading is “Chop”. Choppy tight range price action is tough enough on us humans. But, for computers, it’s deadly! Chop is where I see most automated trading systems breaking down. As with ANY discretionary day trading system, even great ones like the Diversified Trading System (DTS), if you program a machine to take every single signal, your account will slowly dwindle away.

Discretionary trading is truly a craft – part art and part science. It’s the “art” part that messes up auto traders. Top Automated trading programmers say the best auto trading systems do not trade often. But when they take a trade it has a high probability of success and is backed by proper money management rules to maximize the win.

Most discretionary traders don’t have the patience or desire to sit and wait for one or two great trades a day, and I don’t blame them. It’s not natural to sit all day and stare at screens waiting for the exact moment to get into the market. That is something only a machine can do.

I do not think one form of trading, whether it’s wet-ware or hard-ware based, is better than the other. Each has its place in a fully diversified approach to trading.