Day Trading Tips and Tricks

Momentum Acceleration Bands NinjaTrader Indicator

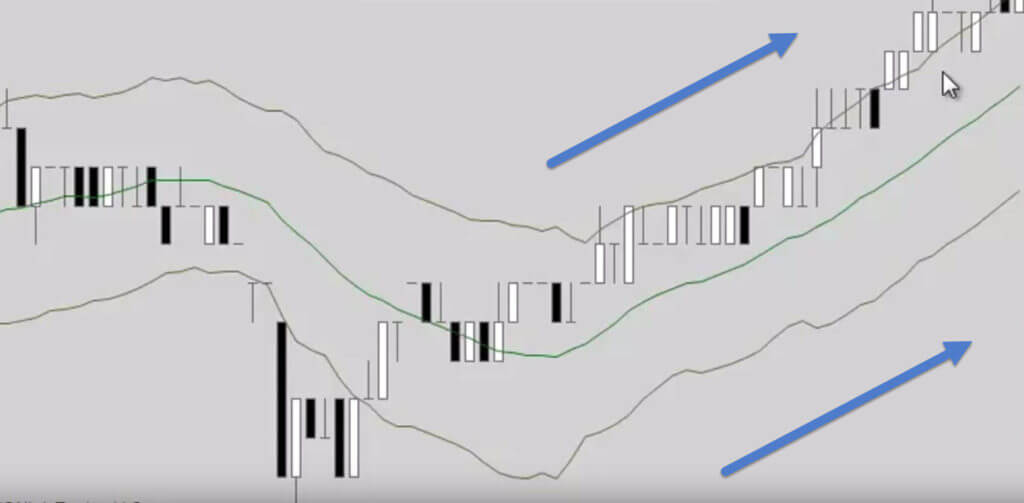

Acceleration Bands provide a different way of viewing momentum. The bands use the trading range of the bar so they will expand and contract based on the volatility of the price.

Momentum Acceleration Bands principal use is in finding the acceleration in currency pair price and benefit as long as this acceleration preserves.

Momentum Acceleration bands are set as an envelope around a 20-period simple moving average on equal distance from it. The inventor of the Momentum Acceleration Bands indicator suggests using them on higher time frames to determine acceleration price breakouts (breakouts outside the bands). When Momentum Acceleration Bands are used for smaller time frames, upper and lower bands are treated as levels of possible support and resistance.

Acceleration bands are based on the volatility of each bar. The values are plotted equidistantly from a median price which serves as the center or middle band. Successive bars exceeding one of the upper or lower bands tends to indicate a possible entry point.

Acceleration bands are based on the volatility of each bar. The values are plotted equidistantly from a median price which serves as the center or middle band. Successive bars exceeding one of the upper or lower bands tends to indicate a possible entry point.

The interpretation of Acceleration Band signals is simple enough — a thrusting move above the top band or below the lower band suggests a stock or index has begun a movement that isn’t just part of its normal volatility. Broadly speaking, Headley prefers to see two consecutive (and progressive) closes on the outside of either Acceleration Band, though that rule of thumb can be tweaked to suit various trading strategies and timeframes.

A breakout outside Momentum Acceleration bands suggests a beginning of a strong rally or a sell-off. Closing inside the bands afterward signals the end of a rally or a sell-off. Two consecutive closes outside Momentum Acceleration Bands suggest an entry point in the direction of the breakout. Then the position is kept till the first close back inside the Bands.

NOTE: The length of the Acceleration band can and should be adjusted from its typical setting of 20 bars to better accommodate differing trading styles and timeframes.