Candlestick chart

| This article needs additional citations for verification. (July 2010) |

A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. Each "candlestick" typically shows one day; so for example a one month chart may show the 20 trading days as 20 "candlesticks".

It is like a combination of line-chart and a bar-chart: each bar represents all four important pieces of information for that day: the open, the close, the high and the low.

Candlestick charts are most often used in technical analysis of equity and currency price patterns. They appear superficially similar to box plots, but are unrelated.

Contents

History[edit]

Candlestick charts are thought to have been developed in the 18th century by Munehisa Homma, Japanese rice trader of financial instruments.[citation needed]. They were introduced to the Western world by Steve Nison in his book, Japanese Candlestick Charting Techniques.[1]

In Beyond Candlesticks,[2] Nison says, "However, based on my research, it is unlikely that Homma used candle charts. As will be seen later, when I discuss the evolution of the candle charts, it was more likely that candle charts were developed in the early part of the Meiji period in Japan (in the late 1800s)."

Description[edit]

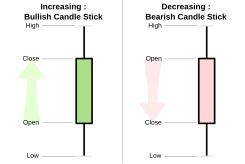

Candlesticks are usually composed of the body (black or white), and an upper and a lower shadow (wick): the area between the open and the close is called the real body, price excursions above and below the real body are called shadows. The wick illustrates the highest and lowest traded prices of a security during the time interval represented. The body illustrates the opening and closing trades. If the security closed higher than it opened, the body is white or unfilled, with the opening price at the bottom of the body and the closing price at the top. If the security closed lower than it opened, the body is black, with the opening price at the top and the closing price at the bottom. A candlestick need not have either a body or a wick.

To better highlight price movements, modern candlestick charts (especially those displayed digitally) often replace the black or white of the candlestick body with colors such as red (for a lower closing) and blue or green (for a higher closing). In some East Asian countries such as Taiwan, China, Japan, and South Korea, the colouring scheme is reversed (red for higher closing, and green/blue for a lower closing).

Candlestick patterns[edit]

In addition to the rather simple patterns depicted in the section above, there are more complex and difficult patterns which have been identified since the charting method's inception. Complex patterns can be colored or highlighted for better visualization.

Candlestick charts also convey more information than other forms of charts, such as Open-high-low-close charts. Just as with bar charts, they display the absolute values of the open, high, low, and closing price for a given period. But they also show how those prices are relative to the prior periods' prices, so one can tell by looking at one bar if the price action is higher or lower than the prior one. Rather than using the open-high-low-close for a given time period (for example, 5 minute, 1 hour, 1 day, 1 month), candlesticks can also be constructed using the open-high-low-close of a specified volume range (for example, 1,000; 100,000; 1 million shares per candlestick).

Usage[edit]

Candlestick charts are a visual aid for decision making in stock, foreign exchange, commodity, and option trading. For example, when the bar is white and high relative to other time periods, it means buyers are very bullish. The opposite is true for a black bar. Candlestick charts serve as a cornerstone of technical analysis.

Heikin Ashi candlesticks[edit]

Heikin-Ashi (平均足, Japanese for 'average bar') candlesticks are a weighted version of candlesticks calculated with the following formula:

- Close = (open + high + low + close) / 4

- High = maximum of high, open, or close (whichever is highest)

- Low = minimum of low, open, or close (whichever is lowest)

- Open = (open of previous bar + close of previous bar) / 2

Heikin-Ashi candlesticks must be used with caution with regards to the price as the body doesn't necessarily sync up with the actual open/close. Unlike with regular candlesticks, a long wick shows more strength, whereas the same period on a standard chart might show a long body with little or no wick. Depending on the software or user preference, Heikin-Ashi may be used to chart the price (instead of line, bar, or candlestick), as an indicator overlaid on a regular chart, or as an indicator plotted on a separate window.

See also[edit]

- Candlestick pattern

- Chart pattern

- Hikkake Pattern

- Kagi chart

- Open-high-low-close chart

- Pivot point calculations

- Spinning top (candlestick pattern)

References[edit]

- ^ Nison, Steve, Japanese Candlestick Charting Techniques, Second Edition. ISBN 978-0-7352-0181-1

- ^ Nison, Steve, Beyond Candlesticks: New Japanese Charting Techniques Revealed, ISBN 978-0-471-00720-3

External links[edit]

| Wikimedia Commons has media related to Candlestick charts. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||