6 Things Required for Making your Best Day Trading Strategy

The first time I bought a trading system. The vendor that sold it to me guaranteed it was the best day trading strategy on the market. Needless to say, I was pretty excited. After getting everyone out the door and off to school, I configured the settings, watched the instructional videos, and then waited for the “big moment.”

It came… sort of… a few times… kind of like they said it would… but not actually.

I was hoping for a lot more.

So I looked for another day trading strategy and bought it, and then another, and another. I did that for a year.

Was I a naive sucker? My brother-in-law said YES! Maybe I was, just a little bit. I certainly gave the vendors the benefit of my doubts.

However, what I said to my brother-in-law is a fact:

===> All successful day traders look for patterns in price action and trading momentum to predict where the market will go next. Most often, they use a combination of indicators with specific settings and follow a set of rules of when to buy and sell.

What do we call that? It is a day trading strategy. Period.

Moreover, that means the everyday trader is either building and honing a day trading strategy or buying a “ready to trade” one. There’s no gray area here.

When I was in the “jungle” of buying day trading education and “holy grail strategy” offers, I spent a significant amount of time learning about trading methods and trading software/indicators.

By default, I became not only an “indicator expert” but also an expert on the programmers who built the indicators.

This momentum led to the creation of Indicator Warehouse where the best, most innovative indicators and strategies are found under one roof.

Now I was a vendor – Yikes! I was on the other side! However, the real benefit of that was getting to know traders and hearing their requests for indicators and added functionality.

This feedback is what made our indicators and tools so valuable to traders and ultimately gave rise to The Diversified Trading Systems.

Here’s a video that stuffs that story into 90 seconds:

Here’s what savvy traders want in a day trading strategy that works:

1. Clear “trade now” signals

Take a look at this actual chart from a trader that was sent to Erich Senft before a private coaching session. Erich asked the gentleman to show him a BUY signal. The poor man was unable to give an answer.

Unfortunately, this scenario is very common with struggling traders. To gain ever greater market intelligence, they load up their chart with more and more indicators to the point where they cannot make a solid decision. Having the skill to interpret this data does not mean you will make more money. For one thing, it will take too long. When you have pondered all the data, the trade opportunity will have passed.

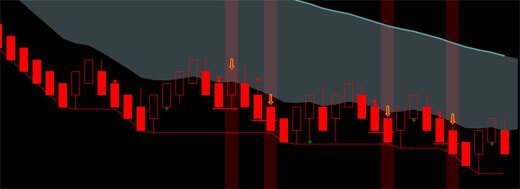

Now, look at this chart showing you how the trade signals work with a Diversified Trading System (DTS).

A “Friendly Warning” dot appears, accompanied by an audible alert. These images and sounds alert you to a possible trade setting up. The audible alarm enables you to monitor multiple markets without having to keep your eyes on each chart. When you hear the Friendly Warning alert, the next step is for you to wait and see if the next set of parameters for a good trade are forthcoming. If the are, you will see an “entry triangle” print on the chart, followed by a “suggested entry” hash mark (horizontal line). There are our trademarked Ready-Set-Go™ alerts.

2. Accuracy

If you’ve tried a few strategies and were less than enthused by their accuracy, you’ll have experienced the most common problem with day trading software.

Regardless of the vendor, the software will have certain guidelines for when to take a trade. These trading rules are often a combination of historical data as well as price and momentum shifts.

You can set the parameters “loosely” so that the parameters are more easily satisfied, but this will decrease overall accuracy. Conversely, the parameters can be adjusted to be very tight – but then you’ll have to wait for a long time for the rules to be satisfied.

This situation is terrible for traders! You are either waiting for the perfect signal, which only comes maybe once a day, or you see many signals – but aren’t sure if they are scalp or trend trades or something in between.

Our solution was to use asset allocation principles and use a diversified and systematic approach to signal generation. The Diversified Trading System integrates three signal generators, each of which looks for something very specific: The Hawk Micro-Scalper picks up only short term scalping signals. The Falcon Swing Trader has been fine tuned to identify mid-range swing trades, and the Eagle Trend Trader is programmed to find long range trend moves. This diversified approach takes advantage of market structure, not matter what the current market state or conditions.

Having three diversified signal generators, therefore, has a tremendous impact on increasing your trading accuracy. It is without a doubt what traders love most because it results in the maximum number of accurate “trade now” signals.

3. Flexibility

If you are day trading, you’ll want to have the option of trading futures, forex, and stocks. Most strategies will work with only one asset class.

Most traders will look for yet another day trading strategy to trade an additional asset class. That is fine, but it does take some time to learn a new method and most often it is impossible to trade them simultaneously. With our DTS strategy, your can monitor any number of markets in a mix of asset classes. You do NOT need different software to trade different asset classes or market conditions.

This flexibility allows you to trade different instruments simultaneously. This functionality sounds overwhelming to most, but with the clarity and unambiguous signals of DTS together with our trade management tools, it is straightforward.

4. Money Management

Frankly, not a lot traders asked for money management software. In fact, we’ve had to drag quite many them into it – kicking and screaming. Nearly every successful (read: wealthy) trader will tell you that it is ALL about money management. In other words, “protecting your account” by putting the odds always in your favor, thereby reduces your risk to the minimum.

With proper money management, you will always only risk the correct amount as well as trade the right number of contracts for the size of your account. This trading truth is crucial. It is nearly impossible to grow your account by only using one contract at a time. Crucial!

Trading is fun. Gambling is fun. However, trading is not gambling. Money management is the “gambling killer.” If you are not interested in money management, you are essentially a gambler having fun…and probably losing.

So, if you are going to be a profitable trader, you must follow the established money management practices. Our DTS trading package includes money management and trade management tools.

5. Trade Management

Now, this WAS something for which we did get many requests. It was the number one subject during coaching sessions. Basically, “How do I know when to get out of the trade?” This point is where traders sweat the most! They either stay in too long or get out too early.

Accurate signals are not enough to make money. Every trader knows that good trade management like money management is the key to success. It is a balancing act. You need to give your trade room to “breathe,” but at the same time not leave more money at risk than you need to. Simply put, traders wanted something that would prevent them from getting stopped out early.

6. Custom Spec Mean Renko Bars

Getting a clear picture of price action is critical to trading success. Again, customers were not screaming for better price action bars. However, now that they have them, they are indeed screaming their praises!

Why so?

With our Custom Mean Renko Bars, you get the look and feel of a traditional candlestick chart combined with the noise reducing, range condensing power of a Renko based bar. However, that is just the start.

Our Renkos have “wicks.” The lack of wicks is a major weakness in a traditional Renko style bar. Wicks allow you to see the full price action on each bar. For example, long wicks can alert you to market indecision while short (or no) wicks might show a strong trend. Wicks also show you the actual high or low of the bar or recent move. None of this is available with a regular Renko style bar.

Bonus #7. Easy rules and methodology to follow

There are many strategies out there that take no time to master. The trouble is, most of them only work in specific market conditions that don’t happen that often. Moreover, there are beautiful yet sophisticated trading methods out there that, unfortunately, take years to learn.

As I am sure you can guess, we had MANY requests for a reliable day trading strategy that can be learned in just a few weeks. The first time Erich taught DTS System Training, it was a live training, Monday to Friday for eight weeks. After three weeks, a third of the traders stopped showing up and after the fourth week, less than half.

Naturally concerned, we emailed the participants and asked them why. In all cases of those who were not showing up, they reported they had no trouble trading with DTS after just a few weeks of instruction. Here is why.